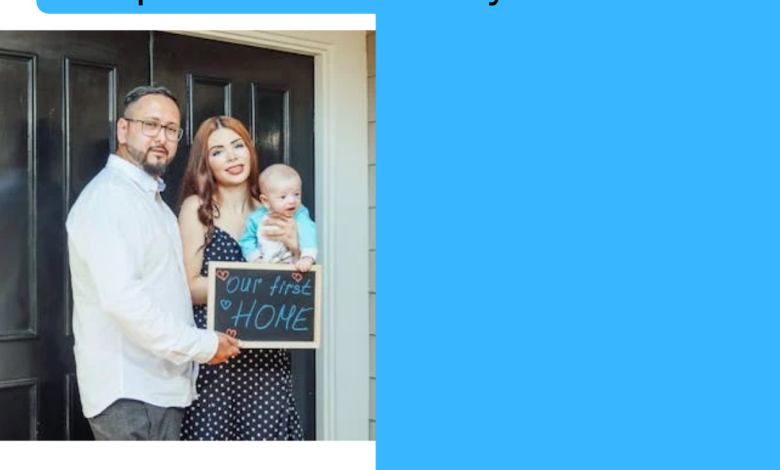

A Complete Guide on How To Buy Your First Home

A Complete Guide on How To Buy Your First Home.Purchasing your first home is a huge life milestone. It’s an exhilarating, at times daunting process that must involve meticulous planning, research and steps to help you ensure you’re making the smartest financial move. We can tell you what to look for in your first property. This guide walks you through each step of the process of buying your first home, which keeps you from common pitfalls that many first-time home buyers encounter, and sets you up for long-term success.

A Complete Guide on How To Buy Your First Home

First-Time Homebuyer: Know your financial situation

Before exploring the housing market, it’s important to evaluate your current financial health. Your financial health will heavily influence whether or not you can get approved for a mortgage, as well as the budget you have to work with for your new home.

Evaluating Your Credit Score

A good credit score is among the most important things lenders look at when deciding if they’ll approve your mortgage application. A high credit score can help set you up for a loan with better terms. You can check your score with several free, online services, and, if you need to, take steps to raise it by paying off some of your debts or paying down your credit card balances.

Setting Your Budget

With your first home purchase, you will need to determine how much is comfortable for you. Think of your income, your debt, your savings, your expenses per month. A mortgage calculator can give you an estimate of how much you can afford based on your income and debt. Financial experts advise keeping your mortgage payment as low as 28% to 30% of your gross monthly income.

Saving for a Down Payment

The size of your down payment can impact your mortgage terms, including interest rates, and monthly payments. The more money you put down on that car, the better your rates may be, but a small down payment could mean larger payments in the long run. Although most first-time homebuyers strive for a deposit of 20%, certain programs like FHA loans or first-time homebuyer grants can help you purchase with as little as 3% down.

THE STEPS TO BUYING YOUR FIRST HOME

Finding the Right Agent Real Estate Agent

Finding the right real estate agent is one of the most important steps in learning how to buy your first home. A good agent will help you through the whole home-buying process, from understanding market conditions to negotiating the price.

Seek out agents with experience of first time buyers and knowledge of the relevant incentives and programs that apply to you. Check if they are licensed and well reputed. Seek recommendations, and gather online reviews before you decide.

Pre-Approval for a Mortgage

After you’ve gotten your finances in order, the next step is obtaining a mortgage pre-approval. This is an important step, as it lets you know how much you can borrow and also helps winnow your choices when you go home shopping.

When you apply for pre-approval, your lender will scrutinize your credit score, income, debts and savings to see how much of a loan you qualify for. Get ready to share documents like W-2s, tax returns and bank statements.

Start House Hunting

Now that you know what you can afford, it’s time to begin your home search. Your real estate agent can help set you up with listings that fit this description — location, number of beds, and amenities. Give yourself time to see several properties, so you can determine what’s available in your price range.

Consider location, too, because your home’s long-term value can hinge on proximity to work, schools and other conveniences. Finally, consider the future resale potential and whether the property will suit your needs long term.

How to Make an Offer and Negotiate

After you’ve identified the right home, it’s time to make an offer. Your real estate agent will help walk you through this process, helping you decide on an offer price based on comparables and current market conditions in the area.

Offer Price

You would expect your first offer to be based around the asking price (potentially offering above or below depending on market conditions). If it’s a seller’s market (where demand outstrips supply), you might have to bid more to be competitive. On the other hand, in a buyers market, you may be able to negotiate more.

Earnest Money Deposit

As part of your offer you will usually need to put down an earnest money deposit (EMD). This is a nominal amount (generally 1% to 2% of the purchase price) that shows you are serious about purchasing the home. If the deal goes wrong because of you, then the seller gets to keep the deposit.

Negotiation and Counteroffer

When the seller receives your offer, they can accept it, reject it or make a counteroffer. Negotiation plays a role when you buy a home, and your agent will help you with this to make sure you’re getting the best possible deal.

Home inspections & appraisals

Home Inspection

Once your offer is accepted, it’s home inspection time. In this important step, potential flaws in property, including plumbing, electrical, or structural problems, are detected. If the inspection uncovers serious problems, you might negotiate repair work or price reductions.

Appraisal

Your lender will need an appraisal to make sure the home’s value is equal to the purchase price. If the appraisal comes in lower than expected, you might have to negotiate the price down with the seller, or you might have to pay a higher down payment estimated at the difference.

Asking and closing the deal on your first home

After all is said and done—inspection results, appraisals, loan approval—now it’s time to seal the deal. This is the last stage of buying a home, and includes signing a number of documents and paying closing costs. These expenses consist of fees for the loan, title insurance, inspections and taxes.

Closing Disclosure

Before closing day, you’ll receive a closing disclosure that details everything financial about the transaction, including loan terms, closing costs, and your final payment. You want to go through this closely to ensure everything is what was discussed in the process.

Final Walkthrough

Prior to the closing, you will often have a chance to do a final walk-through of the property to ensure the state of the home is as agreed upon. Confirm that any repairs or alterations have been done and the house is move-in ready.

Signing the Documents

At closing, you will sign the mortgage documents that make you the officially new owner of the property. You will also pay your down payment and adjust any closing costs. After all that, you’ll get the keys to your new place!

Advice for First-Time Homebuyers

Don’t Rush the Process

Purchasing a home is a big commitment, so take your time and don’t let pressure drive you into making a decision too soon. Your selection should feel right for you.

Consider Future Costs

Bear in mind that there is an ongoing cost to owning a home, such as property taxes, insurance, maintenance and utilities. Factor these costs, and plan to be future-ready for these expenses.

Research First-Time Homebuyer Programs

Many state and local governments also provide support for first-time homebuyers, such as down payment assistance, tax credits and low-interest loans. You must find every opportunity to save money.

Frequently Asked Questions

How much do I need for a deposit on my first home?

The average down payment amount to about 20%, although first-time homebuyers could qualify for loans with a low down payment — as little as 3% down. Some of the programs also provide down payment assistance.

How much can I borrow to purchase a home?

For a conventional loan, the minimum credit score needed to qualify is generally 620 or higher. Federal government-backed loans like FHA loans might even accept lower scores.

How long does one take to buy a house?

From the moment you make an offer on a home, the buying process typically takes around 30 to 60 days, though it can vary based on factors like loan approval and negotiations.

Should I be pre-approved for a mortgage?

Yes, getting pre-approved is an important step when buying a home. It helps you learn how much you can borrow and signals to sellers that you’re a serious buyer.

What’s the difference between preapproval and prequalification?

Pre-qualification gives a general idea of what you might be able to borrow, based on your self-reported finances; pre-approval requires a more in-depth look at your finances and is more reliable.

How to buy a home without a real estate agent?

It can be done, but a real estate agent is strongly recommended. They can walk you through the complex process, negotiate for you and help you avoid expensive mistakes.

Conclusion

Purchasing your first home is an exciting journey but can also be a big financial commitment. By joining an estate agent you can be guided toward based on previous experience to get the best offers so here is one of the breakdown of how the way they work. From evaluating your finances and obtaining a mortgage to bargaining and closing, every stage of your homebuying journey is key to a successful home purchase. Be patient, be orderly, and