Motorcycle insurance for young drivers

Motorcycle Insurance for Young Drivers

As a young driver, owning a motorcycle can be an exhilarating experience, offering freedom and adventure on two wheels. However, it also comes with unique responsibilities, especially when it comes to insurance. Motorcycle insurance is essential for protecting both the rider and the vehicle, but understanding the options and costs can be challenging. This article will guide young drivers through the essentials of motorcycle insurance, highlighting key considerations and tips for finding the right coverage.

Motorcycle insurance for young drivers

Why Is Motorcycle Insurance Important?

- Legal Requirement: In most states, motorcycle insurance is mandatory. Riding without insurance can result in hefty fines and legal consequences.

- Financial Protection: Accidents can be costly. Insurance helps cover medical expenses, repair costs, and potential liability claims if you’re at fault in an accident.

- Peace of Mind: Knowing you have insurance allows you to ride with confidence, reducing anxiety about what might happen on the road.

Types of Motorcycle Insurance Coverage

When purchasing motorcycle insurance, it’s essential to understand the various types of coverage available:

1. Liability Coverage

This is the most basic form of motorcycle insurance and is often required by law. It covers damages to other people’s property and medical expenses if you are at fault in an accident.

2. Collision Coverage

This type of coverage pays for repairs to your motorcycle after an accident, regardless of fault. It is especially important for young drivers who may have less experience on the road.

3. Comprehensive Coverage

Comprehensive insurance covers non-collision incidents, such as theft, vandalism, or damage from natural disasters. This coverage can be crucial for protecting your investment.

4. Uninsured/Underinsured Motorist Coverage

This protects you if you’re involved in an accident with a driver who doesn’t have insurance or whose coverage is insufficient to pay for your damages.

5. Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers in the event of an accident, regardless of fault. This can be particularly valuable for young riders, who may be more vulnerable to injuries.

Motorcycle insurance for young drivers Factors Affecting Insurance Costs for Young Riders

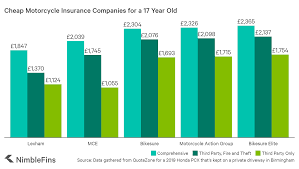

Young drivers typically face higher insurance premiums due to a lack of riding experience and a higher likelihood of accidents. Here are key factors that influence insurance costs:

- Age and Experience: Younger riders generally pay more due to statistically higher accident rates among this demographic.

- Motorcycle Type: The make and model of your motorcycle can significantly impact your insurance premium. Sport bikes often have higher rates due to their speed and performance capabilities.

- Location: Where you live affects insurance costs. Urban areas with higher traffic congestion typically result in higher premiums compared to rural locations.

- Riding History: A clean riding record with no accidents or claims can help lower your premiums.

- Safety Courses: Completing a motorcycle safety course can demonstrate responsibility and skill, often leading to discounts on insurance premiums.

Tips for Young Riders to Lower Insurance Costs

- Shop Around: Don’t settle for the first quote. Compare rates from multiple insurance providers to find the best deal.

- Bundle Policies: If you have other insurance policies (like auto or renter’s insurance), consider bundling them with the same provider for potential discounts.

- Choose the Right Coverage: Evaluate your needs carefully. You may not need comprehensive coverage if your motorcycle is older or less valuable.

- Maintain a Clean Record: Avoid accidents and traffic violations to keep your rates low.

- Ask About Discounts: Many insurers offer discounts for safety features, completing training courses, or being a member of certain motorcycle organizations.

Conclusion

Motorcycle insurance for young drivers .Motorcycle insurance is a crucial aspect of responsible riding for young drivers. By understanding the types of coverage available and the factors influencing premiums, young riders can make informed decisions that protect their finances and well-being. While the cost may seem daunting, shopping around, taking safety courses, and maintaining a good riding record can help keep insurance premiums manageable. Ultimately, the right insurance not only fulfills legal requirements but also provides peace of mind, allowing young riders to focus on enjoying the open road.

One Comment